We believe that sustainable, large-scale change must unite both economic and social development.

Access to financial services is a critical component to solving some of the world’s most persistent problems such as poverty and inequality. Yet, 1.7 billion people in this world do not have access to formal financial services. Financial inclusion is even lower for women and for people living in poverty.

OUR REACH

*As at September 2023

Microfinance is an integral part of BRAC’s holistic approach to development, equipping people who would otherwise be excluded from formal financial systems with the tools to invest in themselves, their families, and their communities.

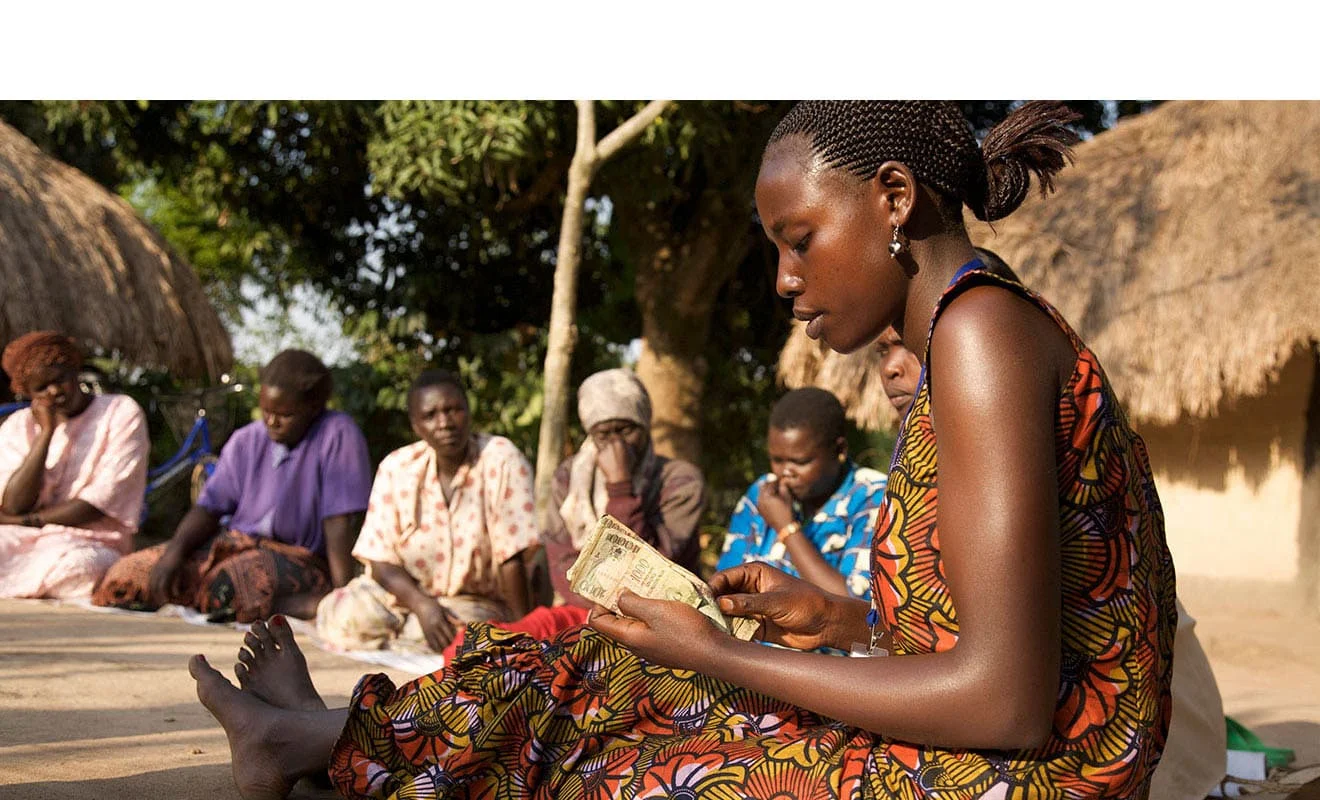

Following decades of experience and insight in delivering financial services to populations living in poverty in Bangladesh, BRAC first expanded its microfinance operations internationally in 2002. Our mission is to provide a range of financial services responsibly to people at the bottom of the pyramid. We particularly focus on women living in poverty in rural and hard-to-reach areas, to create self employment opportunities, build financial resilience, and harness women’s entrepreneurial spirit by empowering them economically. BRAC International Microfinance operates in seven countries outside of Bangladesh. Each company is registered as a separate legal entity and uniquely positioned to serve their markets.

OUR APPROACH

Socially driven

To create a positive impact in the lives of our clients is our only bottom line. We deliver financial services in a way that is transparent, fair, and safe, adhering to the Universal Standards for Social Performance Management and the Client Protection Principles, placing clients’ well-being at the center of everything we do to achieve our mission.

Inclusive financial services

We offer inclusive, accessible, and convenient loan and savings products tailored to the needs of the local community, including women, smallholder farmers, small business owners, and youth. We complement these services with financial literacy training, enabling borrowers to make informed financial decisions.

Empowering women

When women have control of their finances, they are more likely to invest in family needs, such as health care, nutrition, and education for their children. We primarily focus on women, enabling them to become financially resilient and improve the quality of life of their families.

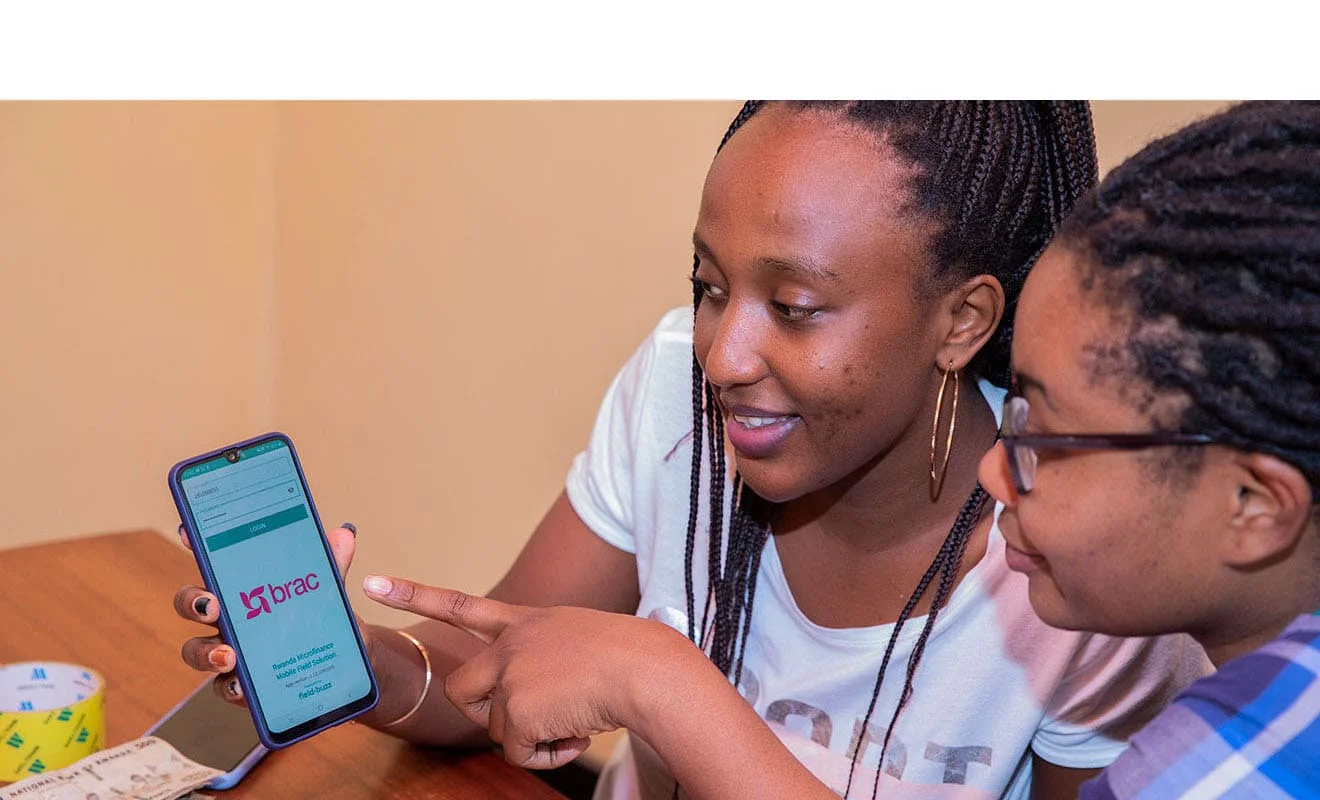

Digital innovation

The client value proposition is at the core of our digital transformation efforts, with a particular emphasis on reducing the gap in women’s digital financial inclusion. We are embracing financial technology by digitising field operations and adopting alternative delivery channels to increase operational efficiency and offer greater convenience to our clients.

Holistic approach

Pairing microfinance with other social services can amplify the impact of our mission. We complement our microfinance services with many of our social development programmes, such as youth empowerment, agriculture and food security, and livelihood programmes.

OUR IMPACT

Microfinance, responsibly delivered, is a powerful tool to increase the inherent resilience and economic empowerment of people living in poverty.

We believe that we can achieve sustainable impact at scale by listening and learning directly from the people we aim to serve.

We started to measure our social performance and desired client-level outcomes from 2019 using Lean Data℠ methodology on five social outcome focus areas of BRAC International Microfinance: quality of life, financial resilience, women’s economic empowerment, self-employment and livelihood opportunities, and household welfare. This regular annual exercise complements our Social Performance Management and Client Protection initiatives, and enables us to set targets and define strategies to reach more people living in poverty to achieve long-term impact.

The fourth impact survey was completed in 2022 using Lean Data℠ methodology in partnership with 60 Decibels. All respondents were women.

Highlights from 2022 Impact Survey

- 94% of clients said their quality of life had improved after engaging with BRAC

- 94% of clients earned more after engaging with BRAC

- 92% of clients saved more after engaging with BRAC

- 92% of clients planned their finances better after engaging with BRAC

- 76% of clients spent more on home improvement after engaging with BRAC

OUR STORIES

BRAC’s loans have helped and inspired me to expand my business when I could not find any other sources of capital. My business is growing day by day and I have more customers now.

– Uwajeneza Brigitte, Rwanda

WHERE WE WORK

Myanmar

BRAC Myanmar Microfinance Company Limited was launched in 2013. It provides inclusive financial services to people living at the bottom of the pyramid, with a strong focus on women living in rural and hard-to-reach areas, and marginalised populations. With 85 branches in 83 townships of the country, it has the third largest branch network among all microfinance operators in Myanmar.Read More →

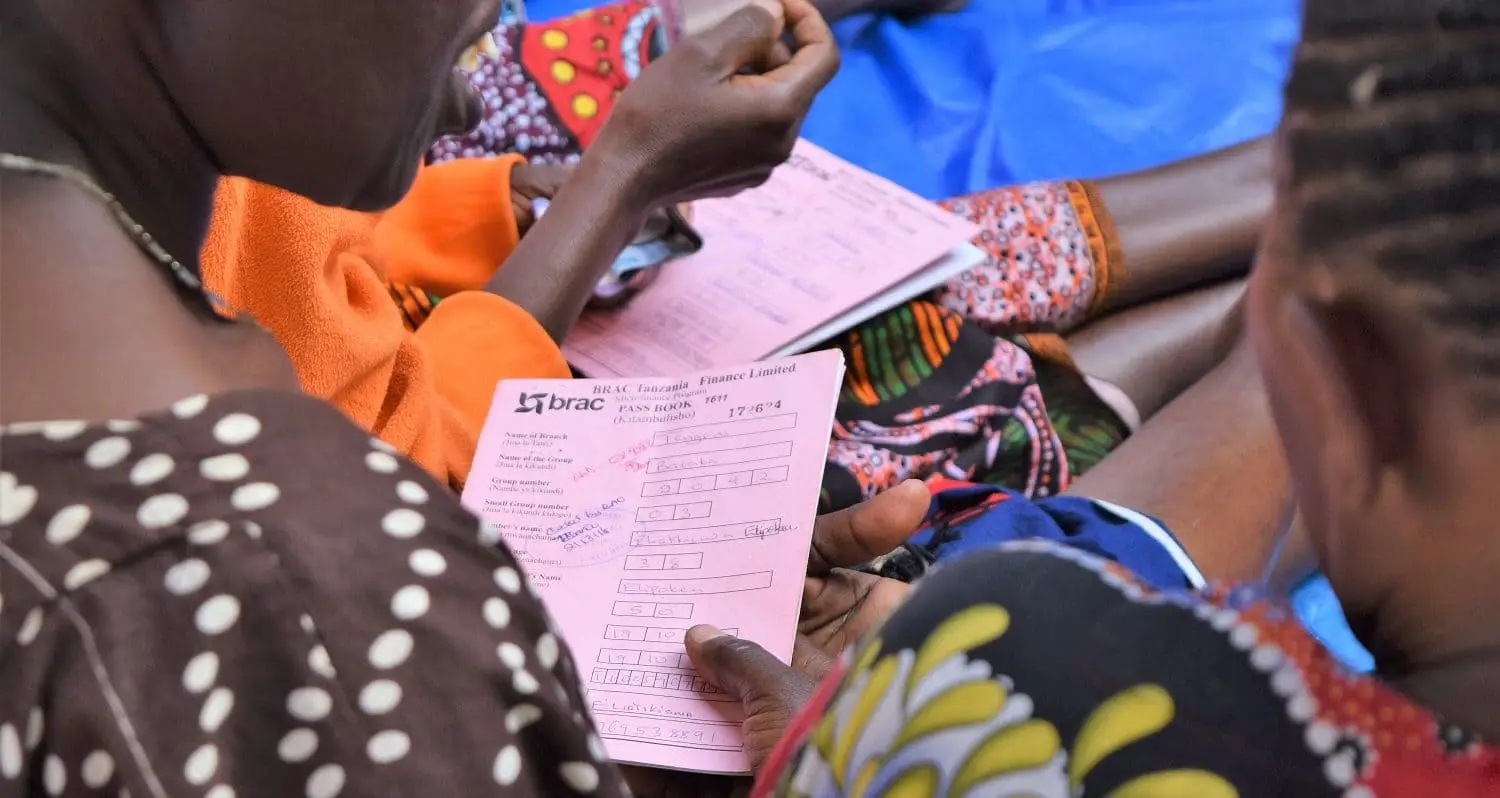

Tanzania

Founded in 2006, BRAC Tanzania Finance Limited is the largest microfinance institution in Tanzania in terms of branch network, active borrowers, and loan outstanding. Across 162 branches, it provides access to finance to people living in poverty, focusing particularly on women living in poverty in rural and hard-to-reach areas.Read More →

Uganda

BRAC started microfinance in Uganda in 2006, as a part of BRAC Uganda’s social development programmes. It transformed into a Tier 2 Credit Institution to become BRAC Uganda Bank Ltd in 2019. BRAC Uganda Bank Ltd has the largest network of banking services in the country, providing inclusive financial services for low income communities to build sustainable livelihoods.Read More →

Rwanda

Having launched microfinance operations in June 2019, BRAC Rwanda Microfinance Company PLC seeks to provide financial services responsibly to people at the bottom of the pyramid. It is the first BRAC International microfinance entity to launch as a deposit-taking institution and fully digitised operations from the outset. Currently, a total of 35 branches have been established in 18 districts, serving 25K borrowers, 98% of whom are women.Read More →

Sierra Leone

BRAC Microfinance Sierra Leone Limited is the largest microfinance institution in Sierra Leone with 42 branches in 12 districts, 60K borrowers, and a loan portfolio of over USD 25.2 million. It provides inclusive financial services to people living in poverty, with a strong focus on women living in rural and hard-to-reach areas.Read More →

Liberia

Launched in 2008, BRAC Liberia Microfinance Company Limited is the largest microfinance institution in Liberia, operating with 45 branches in 7 counties. It provides inclusive financial services to people living in poverty, with a strong focus on women living in rural and hard-to-reach areas.Read More →

Ghana

BRAC Ghana Savings and Loans Ltd and loans was launched in 2023. It is the seventh microfinance entity of BRAC International Holdings B.V. alongside six other microfinance institutions in Liberia, Sierra Leone, Tanzania, Rwanda, Uganda and Myanmar.Learn more →

LATEST FROM US

RESEARCH EVIDENCE

BRAC believes that sustainable, large-scale change must address and deliver both economic and social progress. Microfinance is an integral part of BRAC’s holistic approach to development, equipping people with the tools to invest in themselves, their families, and their communities.

BRAC International Microfinance (BI MF) has been measuring its social performance and desired client-level outcomes since 2019 using the Lean Data℠ methodology. Survey results from the past two years show that client-centric microfinance remains a critical tool for people living in poverty, particularly women, to improve their quality of life and strengthen their resilience, even in the face of a crisis.

BRAC’s microfinance programme always intends to complement BRAC’s social development interventions to amplify the impact of BRAC’s work. A study in Uganda on 8,768 respondents reaffirmed that complementing microfinance with other sectoral interventions brings greater impact.

An experimental study in Liberia found that clients of BRAC’s Small Enterprise Loan product who received business-management skills and interpersonal skills trainings experienced an increase in attention to customers, which consequently enhanced the performance of the businesses, including higher average monthly revenue, less loss of customers, and a smaller likelihood of encountering business losses.

An experimental study in Uganda on 3000 women borrowers examined whether disbursing loans directly onto a digital account enables microfinance borrowers to grow their businesses. The study found that women who received their microfinance loan on the mobile money account had 11% higher levels of business capital and 15% higher business profits compared to a control group who received their loan as cash. Total household income and consumption were also higher.

RESEARCH BRIEFS OF RELATED STUDIES

PARTNERS